Predict House price

Objective: To determine the price of the house using deep neural network. We’ve been provided with historical data and fetaures of the house.

Source: Udemy | Python for Data Science and Machine Learning Bootcamp

Data used in the below analysis: Housing data from Kaggle.

#Importing libraries as required

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

sns.set_style('whitegrid')

data = pd.read_csv('DATA/kc_house_data.csv') #read dataset

Starting with some EDA! (Explanatory Data Analysis)

data.isnull().sum() #checking for null data

id 0

date 0

price 0

bedrooms 0

bathrooms 0

sqft_living 0

sqft_lot 0

floors 0

waterfront 0

view 0

condition 0

grade 0

sqft_above 0

sqft_basement 0

yr_built 0

yr_renovated 0

zipcode 0

lat 0

long 0

sqft_living15 0

sqft_lot15 0

dtype: int64

The data has no null values

#viewing some basic info about the dataset

data.describe().transpose()

| count | mean | std | min | 25% | 50% | 75% | max | |

|---|---|---|---|---|---|---|---|---|

| id | 21597.0 | 4.580474e+09 | 2.876736e+09 | 1.000102e+06 | 2.123049e+09 | 3.904930e+09 | 7.308900e+09 | 9.900000e+09 |

| price | 21597.0 | 5.402966e+05 | 3.673681e+05 | 7.800000e+04 | 3.220000e+05 | 4.500000e+05 | 6.450000e+05 | 7.700000e+06 |

| bedrooms | 21597.0 | 3.373200e+00 | 9.262989e-01 | 1.000000e+00 | 3.000000e+00 | 3.000000e+00 | 4.000000e+00 | 3.300000e+01 |

| bathrooms | 21597.0 | 2.115826e+00 | 7.689843e-01 | 5.000000e-01 | 1.750000e+00 | 2.250000e+00 | 2.500000e+00 | 8.000000e+00 |

| sqft_living | 21597.0 | 2.080322e+03 | 9.181061e+02 | 3.700000e+02 | 1.430000e+03 | 1.910000e+03 | 2.550000e+03 | 1.354000e+04 |

| sqft_lot | 21597.0 | 1.509941e+04 | 4.141264e+04 | 5.200000e+02 | 5.040000e+03 | 7.618000e+03 | 1.068500e+04 | 1.651359e+06 |

| floors | 21597.0 | 1.494096e+00 | 5.396828e-01 | 1.000000e+00 | 1.000000e+00 | 1.500000e+00 | 2.000000e+00 | 3.500000e+00 |

| waterfront | 21597.0 | 7.547345e-03 | 8.654900e-02 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 1.000000e+00 |

| view | 21597.0 | 2.342918e-01 | 7.663898e-01 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 4.000000e+00 |

| condition | 21597.0 | 3.409825e+00 | 6.505456e-01 | 1.000000e+00 | 3.000000e+00 | 3.000000e+00 | 4.000000e+00 | 5.000000e+00 |

| grade | 21597.0 | 7.657915e+00 | 1.173200e+00 | 3.000000e+00 | 7.000000e+00 | 7.000000e+00 | 8.000000e+00 | 1.300000e+01 |

| sqft_above | 21597.0 | 1.788597e+03 | 8.277598e+02 | 3.700000e+02 | 1.190000e+03 | 1.560000e+03 | 2.210000e+03 | 9.410000e+03 |

| sqft_basement | 21597.0 | 2.917250e+02 | 4.426678e+02 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 5.600000e+02 | 4.820000e+03 |

| yr_built | 21597.0 | 1.971000e+03 | 2.937523e+01 | 1.900000e+03 | 1.951000e+03 | 1.975000e+03 | 1.997000e+03 | 2.015000e+03 |

| yr_renovated | 21597.0 | 8.446479e+01 | 4.018214e+02 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 0.000000e+00 | 2.015000e+03 |

| zipcode | 21597.0 | 9.807795e+04 | 5.351307e+01 | 9.800100e+04 | 9.803300e+04 | 9.806500e+04 | 9.811800e+04 | 9.819900e+04 |

| lat | 21597.0 | 4.756009e+01 | 1.385518e-01 | 4.715590e+01 | 4.747110e+01 | 4.757180e+01 | 4.767800e+01 | 4.777760e+01 |

| long | 21597.0 | -1.222140e+02 | 1.407235e-01 | -1.225190e+02 | -1.223280e+02 | -1.222310e+02 | -1.221250e+02 | -1.213150e+02 |

| sqft_living15 | 21597.0 | 1.986620e+03 | 6.852305e+02 | 3.990000e+02 | 1.490000e+03 | 1.840000e+03 | 2.360000e+03 | 6.210000e+03 |

| sqft_lot15 | 21597.0 | 1.275828e+04 | 2.727444e+04 | 6.510000e+02 | 5.100000e+03 | 7.620000e+03 | 1.008300e+04 | 8.712000e+05 |

data.head()

| id | date | price | bedrooms | bathrooms | sqft_living | sqft_lot | floors | waterfront | view | ... | grade | sqft_above | sqft_basement | yr_built | yr_renovated | zipcode | lat | long | sqft_living15 | sqft_lot15 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 7129300520 | 10/13/2014 | 221900.0 | 3 | 1.00 | 1180 | 5650 | 1.0 | 0 | 0 | ... | 7 | 1180 | 0 | 1955 | 0 | 98178 | 47.5112 | -122.257 | 1340 | 5650 |

| 1 | 6414100192 | 12/9/2014 | 538000.0 | 3 | 2.25 | 2570 | 7242 | 2.0 | 0 | 0 | ... | 7 | 2170 | 400 | 1951 | 1991 | 98125 | 47.7210 | -122.319 | 1690 | 7639 |

| 2 | 5631500400 | 2/25/2015 | 180000.0 | 2 | 1.00 | 770 | 10000 | 1.0 | 0 | 0 | ... | 6 | 770 | 0 | 1933 | 0 | 98028 | 47.7379 | -122.233 | 2720 | 8062 |

| 3 | 2487200875 | 12/9/2014 | 604000.0 | 4 | 3.00 | 1960 | 5000 | 1.0 | 0 | 0 | ... | 7 | 1050 | 910 | 1965 | 0 | 98136 | 47.5208 | -122.393 | 1360 | 5000 |

| 4 | 1954400510 | 2/18/2015 | 510000.0 | 3 | 2.00 | 1680 | 8080 | 1.0 | 0 | 0 | ... | 8 | 1680 | 0 | 1987 | 0 | 98074 | 47.6168 | -122.045 | 1800 | 7503 |

5 rows × 21 columns

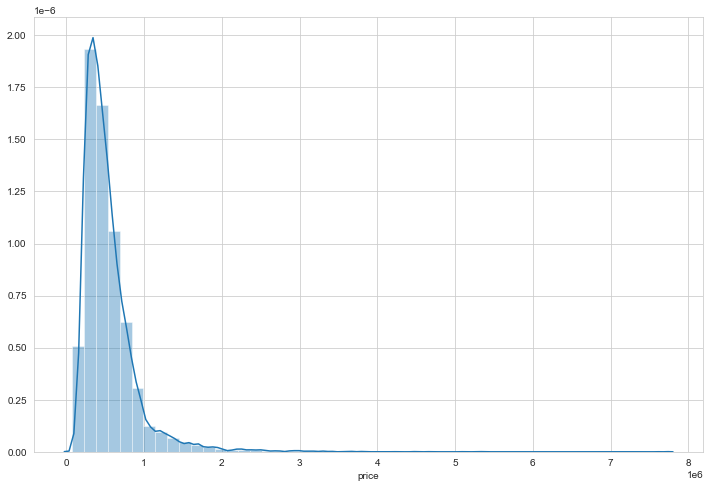

#looking at the price range, the feature to be predicted

plt.figure(figsize=(12,8))

sns.distplot(data['price'])

The data is mostly concentrated around 1,000,000 - 2,000,000 with few houses at 3,000,000 and even at around 7,500,000

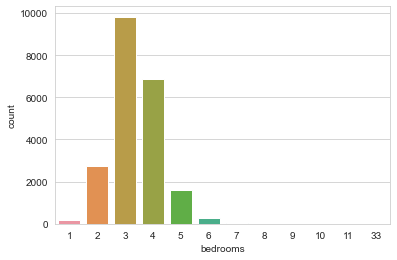

sns.countplot(data['bedrooms'])

The data mostly contains houses with 3 bedrooms

#Checking the correlation of price with other features!

data.corr()['price'].sort_values()

zipcode -0.053402

id -0.016772

long 0.022036

condition 0.036056

yr_built 0.053953

sqft_lot15 0.082845

sqft_lot 0.089876

yr_renovated 0.126424

floors 0.256804

waterfront 0.266398

lat 0.306692

bedrooms 0.308787

sqft_basement 0.323799

view 0.397370

bathrooms 0.525906

sqft_living15 0.585241

sqft_above 0.605368

grade 0.667951

sqft_living 0.701917

price 1.000000

Name: price, dtype: float64

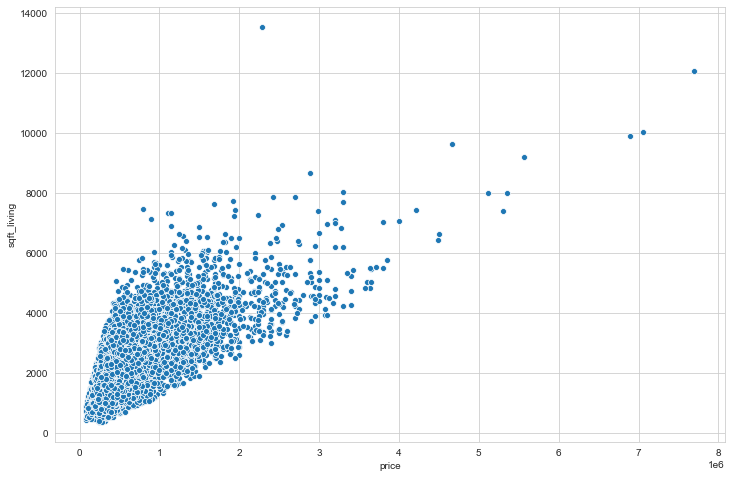

The most correlated is the Square footage of the apartments interior living space with 0.71. We can see that in the below plot as well!

plt.figure(figsize=(12,8))

sns.scatterplot(x='price',y='sqft_living',data=data)

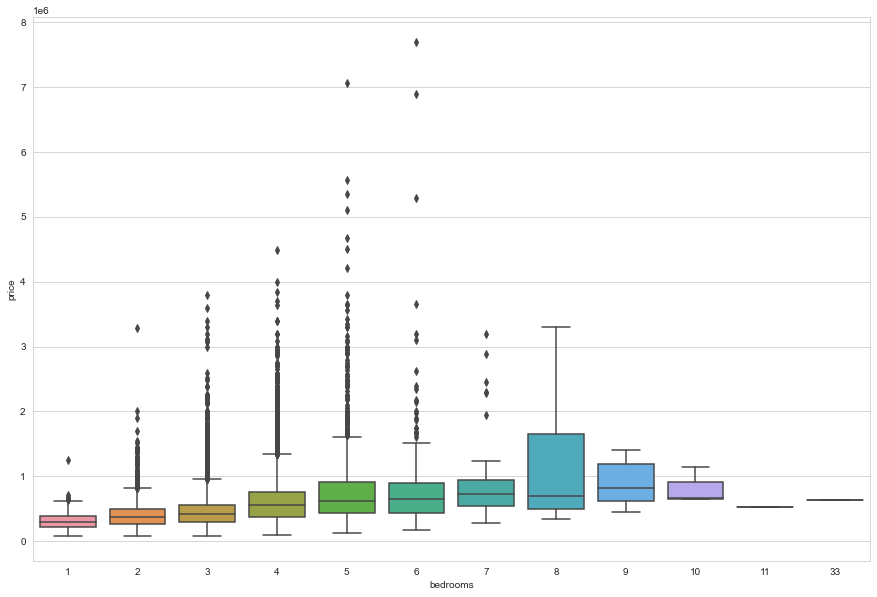

#Num of bedrooms vs price of the house

plt.figure(figsize=(15,10))

sns.boxplot(x='bedrooms',y='price',data=data)

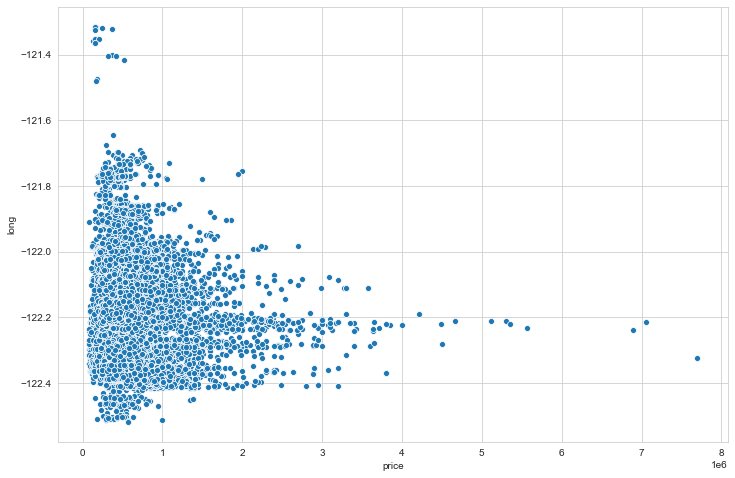

#price vs longitude

plt.figure(figsize=(12,8))

sns.scatterplot(x='price',y='long',data=data)

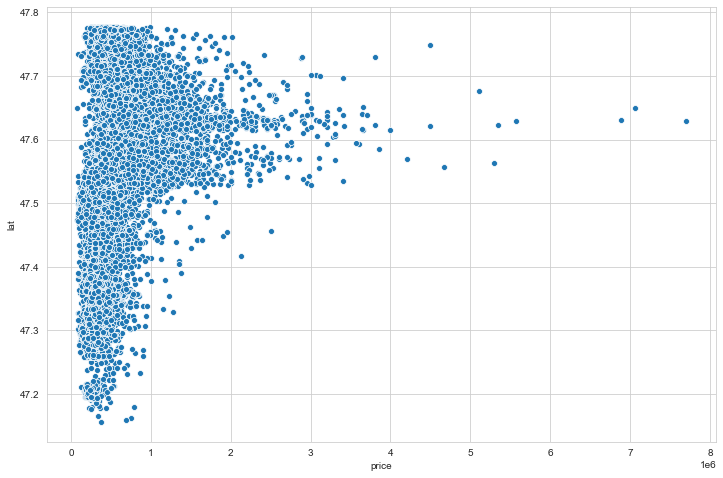

#price vs latitude

plt.figure(figsize=(12,8))

sns.scatterplot(x='price',y='lat',data=data)

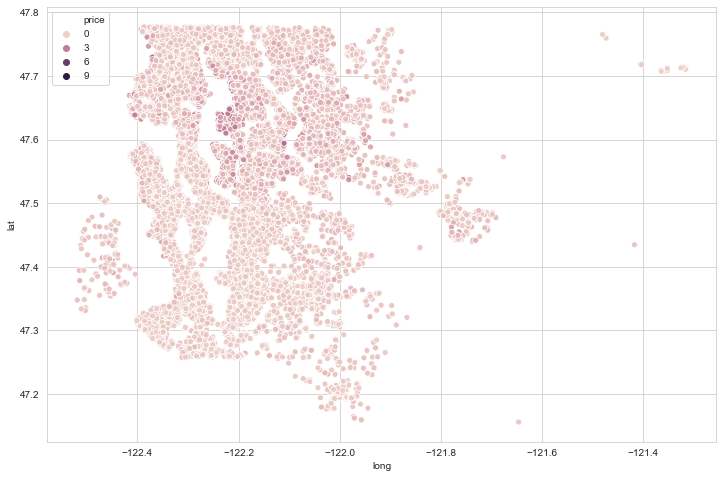

#plotting price with longitude and langitude can give us expensive areas in the given region

plt.figure(figsize=(12,8))

sns.scatterplot(x='long',y='lat',data=data,hue='price')

We can clean data to get a better plot of house prices

#getting the price outliers - most priced houses

data.sort_values('price',ascending=False).head(20)

| id | date | price | bedrooms | bathrooms | sqft_living | sqft_lot | floors | waterfront | view | ... | grade | sqft_above | sqft_basement | yr_built | yr_renovated | zipcode | lat | long | sqft_living15 | sqft_lot15 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 7245 | 6762700020 | 10/13/2014 | 7700000.0 | 6 | 8.00 | 12050 | 27600 | 2.5 | 0 | 3 | ... | 13 | 8570 | 3480 | 1910 | 1987 | 98102 | 47.6298 | -122.323 | 3940 | 8800 |

| 3910 | 9808700762 | 6/11/2014 | 7060000.0 | 5 | 4.50 | 10040 | 37325 | 2.0 | 1 | 2 | ... | 11 | 7680 | 2360 | 1940 | 2001 | 98004 | 47.6500 | -122.214 | 3930 | 25449 |

| 9245 | 9208900037 | 9/19/2014 | 6890000.0 | 6 | 7.75 | 9890 | 31374 | 2.0 | 0 | 4 | ... | 13 | 8860 | 1030 | 2001 | 0 | 98039 | 47.6305 | -122.240 | 4540 | 42730 |

| 4407 | 2470100110 | 8/4/2014 | 5570000.0 | 5 | 5.75 | 9200 | 35069 | 2.0 | 0 | 0 | ... | 13 | 6200 | 3000 | 2001 | 0 | 98039 | 47.6289 | -122.233 | 3560 | 24345 |

| 1446 | 8907500070 | 4/13/2015 | 5350000.0 | 5 | 5.00 | 8000 | 23985 | 2.0 | 0 | 4 | ... | 12 | 6720 | 1280 | 2009 | 0 | 98004 | 47.6232 | -122.220 | 4600 | 21750 |

| 1313 | 7558700030 | 4/13/2015 | 5300000.0 | 6 | 6.00 | 7390 | 24829 | 2.0 | 1 | 4 | ... | 12 | 5000 | 2390 | 1991 | 0 | 98040 | 47.5631 | -122.210 | 4320 | 24619 |

| 1162 | 1247600105 | 10/20/2014 | 5110000.0 | 5 | 5.25 | 8010 | 45517 | 2.0 | 1 | 4 | ... | 12 | 5990 | 2020 | 1999 | 0 | 98033 | 47.6767 | -122.211 | 3430 | 26788 |

| 8085 | 1924059029 | 6/17/2014 | 4670000.0 | 5 | 6.75 | 9640 | 13068 | 1.0 | 1 | 4 | ... | 12 | 4820 | 4820 | 1983 | 2009 | 98040 | 47.5570 | -122.210 | 3270 | 10454 |

| 2624 | 7738500731 | 8/15/2014 | 4500000.0 | 5 | 5.50 | 6640 | 40014 | 2.0 | 1 | 4 | ... | 12 | 6350 | 290 | 2004 | 0 | 98155 | 47.7493 | -122.280 | 3030 | 23408 |

| 8629 | 3835500195 | 6/18/2014 | 4490000.0 | 4 | 3.00 | 6430 | 27517 | 2.0 | 0 | 0 | ... | 12 | 6430 | 0 | 2001 | 0 | 98004 | 47.6208 | -122.219 | 3720 | 14592 |

| 12358 | 6065300370 | 5/6/2015 | 4210000.0 | 5 | 6.00 | 7440 | 21540 | 2.0 | 0 | 0 | ... | 12 | 5550 | 1890 | 2003 | 0 | 98006 | 47.5692 | -122.189 | 4740 | 19329 |

| 4145 | 6447300265 | 10/14/2014 | 4000000.0 | 4 | 5.50 | 7080 | 16573 | 2.0 | 0 | 0 | ... | 12 | 5760 | 1320 | 2008 | 0 | 98039 | 47.6151 | -122.224 | 3140 | 15996 |

| 2083 | 8106100105 | 11/14/2014 | 3850000.0 | 4 | 4.25 | 5770 | 21300 | 2.0 | 1 | 4 | ... | 11 | 5770 | 0 | 1980 | 0 | 98040 | 47.5850 | -122.222 | 4620 | 22748 |

| 7028 | 853200010 | 7/1/2014 | 3800000.0 | 5 | 5.50 | 7050 | 42840 | 1.0 | 0 | 2 | ... | 13 | 4320 | 2730 | 1978 | 0 | 98004 | 47.6229 | -122.220 | 5070 | 20570 |

| 19002 | 2303900100 | 9/11/2014 | 3800000.0 | 3 | 4.25 | 5510 | 35000 | 2.0 | 0 | 4 | ... | 13 | 4910 | 600 | 1997 | 0 | 98177 | 47.7296 | -122.370 | 3430 | 45302 |

| 16288 | 7397300170 | 5/30/2014 | 3710000.0 | 4 | 3.50 | 5550 | 28078 | 2.0 | 0 | 2 | ... | 12 | 3350 | 2200 | 2000 | 0 | 98039 | 47.6395 | -122.234 | 2980 | 19602 |

| 18467 | 4389201095 | 5/11/2015 | 3650000.0 | 5 | 3.75 | 5020 | 8694 | 2.0 | 0 | 1 | ... | 12 | 3970 | 1050 | 2007 | 0 | 98004 | 47.6146 | -122.213 | 4190 | 11275 |

| 6502 | 4217402115 | 4/21/2015 | 3650000.0 | 6 | 4.75 | 5480 | 19401 | 1.5 | 1 | 4 | ... | 11 | 3910 | 1570 | 1936 | 0 | 98105 | 47.6515 | -122.277 | 3510 | 15810 |

| 15241 | 2425049063 | 9/11/2014 | 3640000.0 | 4 | 3.25 | 4830 | 22257 | 2.0 | 1 | 4 | ... | 11 | 4830 | 0 | 1990 | 0 | 98039 | 47.6409 | -122.241 | 3820 | 25582 |

| 19133 | 3625049042 | 10/11/2014 | 3640000.0 | 5 | 6.00 | 5490 | 19897 | 2.0 | 0 | 0 | ... | 12 | 5490 | 0 | 2005 | 0 | 98039 | 47.6165 | -122.236 | 2910 | 17600 |

20 rows × 21 columns

We can disregard a % of entries to remove outliers and get better model predictions!

len(data)*0.01

215.97

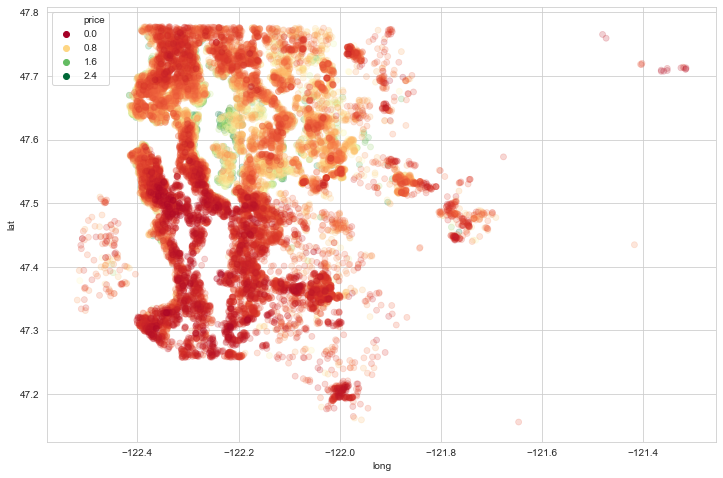

non_top_1_percent = data.sort_values('price',ascending=False).iloc[216:]

plt.figure(figsize=(12,8))

sns.scatterplot(x='long',y='lat',data=non_top_1_percent,

edgecolor=None, alpha=0.2, palette = 'RdYlGn', hue='price')

We can clearly see the most expensive housing areas now!

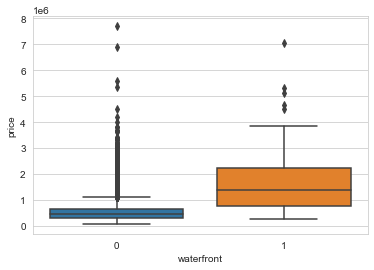

#Checking the price of houses on the waterfront

#As per the above plot, they seem to be more expensive

sns.boxplot(x='waterfront',y='price',data=data)

Start with feature engineering! We need to clean data for model to give better results!

#Dropping unnecessary fields!

data.drop('id',axis=1,inplace=True)

#converting date into something usefull

data['date'] = pd.to_datetime(data['date'])

data['year'] = data['date'].apply(lambda x : x.year)

data['month'] = data['date'].apply(lambda x : x.month)

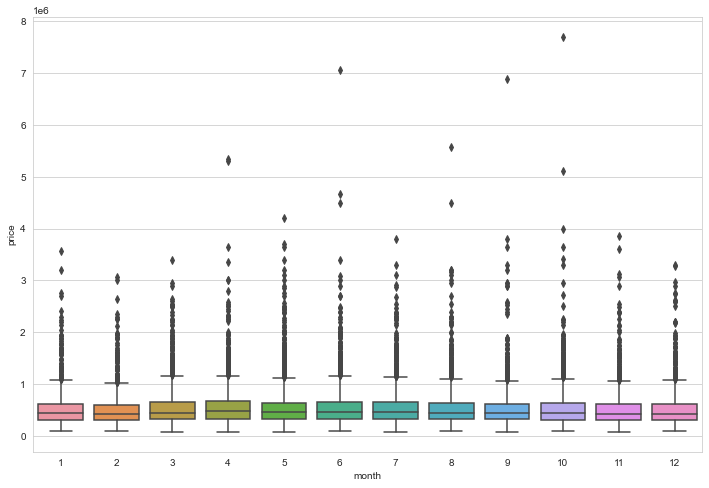

#checking month vs price of house

plt.figure(figsize=(12,8))

sns.boxplot(x='month',y='price',data=data)

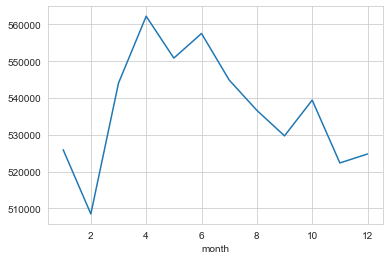

data.groupby(by='month').mean()['price'].plot()

#price vs year

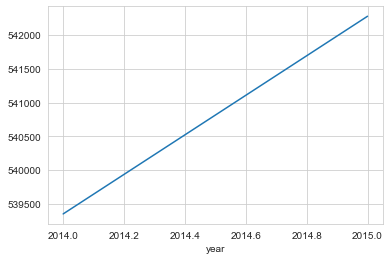

data.groupby(by='year').mean()['price'].plot()

There seems to an expected relationship with year and mean prices of the house

data.drop('date',axis=1,inplace=True) #dropping date as we already have extracted its features

data['zipcode'].value_counts() #checking unique values to get the idea of the data

98103 602

98038 589

98115 583

98052 574

98117 553

...

98102 104

98010 100

98024 80

98148 57

98039 50

Name: zipcode, Length: 70, dtype: int64

#dropping as it don't seem to affect price much

#Seen before, has -ve correlation

data.drop('zipcode',axis=1,inplace=True)

data['yr_renovated'].value_counts()

0 20683

2014 91

2013 37

2003 36

2000 35

...

1934 1

1959 1

1951 1

1948 1

1944 1

Name: yr_renovated, Length: 70, dtype: int64

We can convert the above data into two options, renovated or non renovated for our price predictions. We are lucky we have years and renovated already in high correlation with price, intuitively we can use the data as is

data['sqft_basement'].value_counts()

0 13110

600 221

700 218

500 214

800 206

...

792 1

2590 1

935 1

2390 1

248 1

Name: sqft_basement, Length: 306, dtype: int64

Same case with the basement area!

Training the model

#train test split

X = data.drop('price', axis=1).values

y = data['price'].values

from sklearn.model_selection import train_test_split

Xtrain, Xtest, ytrain, ytest = train_test_split(X,y,test_size = 0.3,

random_state=101)

#Scaling the data

from sklearn.preprocessing import MinMaxScaler

scale = MinMaxScaler()

#fit and transform together

Xtrain = scale.fit_transform(Xtrain)

#we don't fit test data so that no info leak is there while training data

Xtest = scale.transform(Xtest)

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense

from tensorflow.keras.optimizers import Adam

Creating a Sequential model with activation function as rectified linear, and a dense network where every neuron is connected to every other neuron. Also, the loss function used is Mean Squared Error and Adam is used as a gradient descent optimizer.

model = Sequential()

model.add(Dense(19,activation='relu'))

model.add(Dense(19,activation='relu'))

model.add(Dense(19,activation='relu'))

model.add(Dense(19,activation='relu'))

model.add(Dense(1))

model.compile(optimizer='adam',loss='mse')

model.fit(x=Xtrain,y=ytrain,

validation_data=(Xtest,ytest),

batch_size = 128, epochs=400)

Epoch 1/400

119/119 [==============================] - 0s 3ms/step - loss: 430242594816.0000 - val_loss: 418922102784.0000

Epoch 2/400

119/119 [==============================] - 0s 2ms/step - loss: 428868403200.0000 - val_loss: 413837787136.0000

Epoch 3/400

119/119 [==============================] - 0s 2ms/step - loss: 407161012224.0000 - val_loss: 363431297024.0000

Epoch 4/400

119/119 [==============================] - 0s 2ms/step - loss: 303796158464.0000 - val_loss: 206461501440.0000

Epoch 5/400

119/119 [==============================] - 0s 2ms/step - loss: 143996928000.0000 - val_loss: 98603425792.0000

.

.

.

Epoch 400/400

119/119 [==============================] - 0s 2ms/step - loss: 29113778176.0000 - val_loss: 26656872448.0000

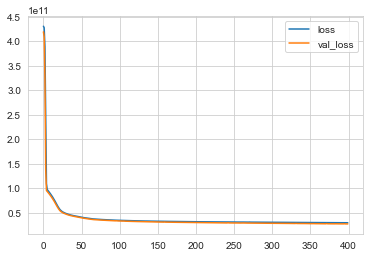

losses = pd.DataFrame(model.history.history)

losses.plot()

Expected behaviour of our model with loss vs Val_loss. We can train at more epochs as loss is still over val_loss and it’s not overfitting yet

Evaluating the model performance

from sklearn.metrics import mean_absolute_error, mean_squared_error, explained_variance_score

predictions = model.predict(Xtest)

print("Mean_absolute_error:", mean_absolute_error(ytest,predictions))

print("Mean_squared_error:", mean_squared_error(ytest,predictions))

print("Root_Mean_Squared_error:", np.sqrt(mean_squared_error(ytest,predictions)))

Mean_absolute_error: 101612.238435571

Mean_squared_error: 26656866746.557117

Root_Mean_Squared_error: 163269.30742352377

data['price'].describe()['mean'] #checking the mean price

540296.5735055795

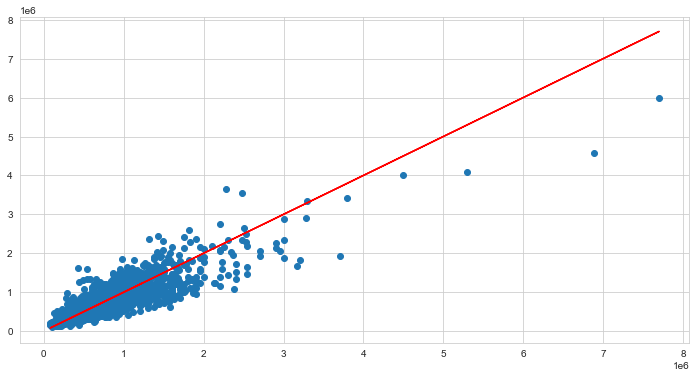

Our model is off by about 19% (Mean absolute error) of the mean value of price. It is not too bad but not great as such

#this tells how much variance our model can explain

#lower value is worse, best value is 1.0

explained_variance_score(ytest,predictions)

0.799128091503277

plt.figure(figsize=(12,6))

plt.scatter(ytest,predictions)

# Perfect predictions

plt.plot(ytest,ytest,'r')

The plot of predicted vs true values seem fine except for some outliers

Predicting a new value

single_house = data.drop('price',axis=1).iloc[0] #creating a entry to check the model

single_house = scale.transform(single_house.values.reshape(-1, 19)) #transform to fit into model

print("Error:", abs(data.iloc[0]['price']-model.predict(single_house)[0][0]))

Error: 63496.40625

We can try to reduce error on the current rendered model by removing outliers and by increasing the epochs. We’ll try with removing outliers.

Re-training and evaluating the model

non_top_1_percent.drop('id',axis=1,inplace=True)

non_top_1_percent['date'] = pd.to_datetime(non_top_1_percent['date'])

non_top_1_percent['year'] = non_top_1_percent['date'].apply(lambda x : x.year)

non_top_1_percent['month'] = non_top_1_percent['date'].apply(lambda x : x.month)

non_top_1_percent.drop('date',axis=1,inplace=True)

non_top_1_percent.drop('zipcode',axis=1,inplace=True)

#train test split

X = non_top_1_percent.drop('price', axis=1).values

y = non_top_1_percent['price'].values

Xtrain, Xtest, ytrain, ytest = train_test_split(X,y,test_size = 0.3,

random_state=101)

Xtrain = scale.fit_transform(Xtrain)

Xtest = scale.transform(Xtest)

model.fit(x=Xtrain,y=ytrain,

validation_data=(Xtest,ytest),

batch_size = 128, epochs=400)

Epoch 1/400

117/117 [==============================] - 0s 3ms/step - loss: 24656377856.0000 - val_loss: 22707032064.0000

Epoch 2/400

117/117 [==============================] - 0s 2ms/step - loss: 21469505536.0000 - val_loss: 21987682304.0000

Epoch 3/400

117/117 [==============================] - 0s 2ms/step - loss: 21053581312.0000 - val_loss: 21625681920.0000

Epoch 4/400

117/117 [==============================] - 0s 2ms/step - loss: 20826849280.0000 - val_loss: 21429176320.0000

Epoch 5/400

117/117 [==============================] - 0s 3ms/step - loss: 20693381120.0000 - val_loss: 21351958528.0000

.

.

.

Epoch 400/400

117/117 [==============================] - 0s 2ms/step - loss: 12499646464.0000 - val_loss: 13185313792.0000

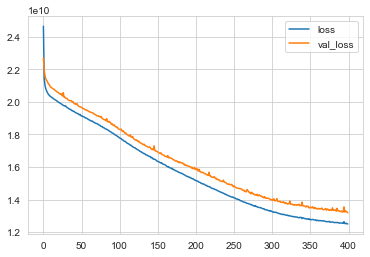

losses = pd.DataFrame(model.history.history)

losses.plot()

The new model shows some spikes in the val_loss which means its overfitting at 400 epochs. We’ll ignore them for now

predictions = model.predict(Xtest)

print("Mean_absolute_error:", mean_absolute_error(ytest,predictions))

print("Mean_squared_error:", mean_squared_error(ytest,predictions))

print("Root_Mean_Squared_error:", np.sqrt(mean_squared_error(ytest,predictions)))

non_top_1_percent['price'].describe()['mean']

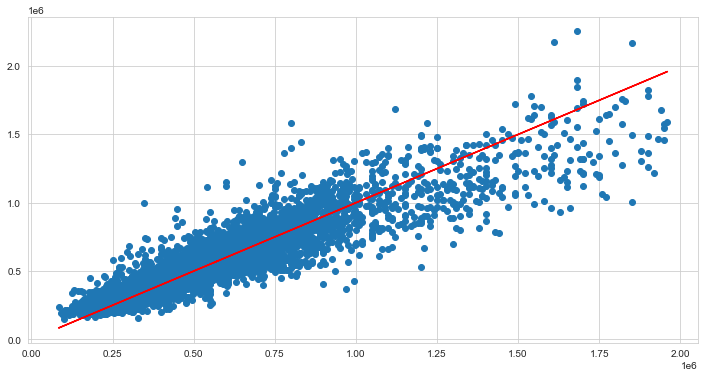

Mean_absolute_error: 75475.24519924006

Mean_squared_error: 13185316548.521532

Root_Mean_Squared_error: 114827.33362976575

518367.48037977645

explained_variance_score(ytest,predictions)

0.8400017690813121

plt.figure(figsize=(12,6))

plt.scatter(ytest,predictions)

# Perfect predictions

plt.plot(ytest,ytest,'r')

single_house = data.drop('price',axis=1).iloc[0]

single_house = scale.transform(single_house.values.reshape(-1, 19))

print("Error:", abs(data.iloc[0]['price']-model.predict(single_house)[0][0]))

Error: 39714.4375

The error in prediction has also reduced from before